Tirana International Airport: Routes and Growth Statistics Analyzed

Comprehensive data-driven analysis of Tirana International Airport's growth, examining trends in passenger numbers, route performance, and the strategic initiatives driving Albania's aviation sector forward.

Your First 10 Rides Discounted 🚕

Use "WEB" as your referral code, for a free 50 Toko bonus.

Tirana International Airport (TIA), or Nënë Tereza Airport, has solidified its place as Albania’s aviation hub, connecting the country to over 70 destinations globally. We’ll explore data since 2019, where TIA has navigated the highs of growing tourism, the lows of the pandemic, and the rapid recovery that followed. Using insights from the TIA Market Statistics and the INSTAT Air Transport Reports, we’ll explore the airport’s recent routes and growth.

Note: Passenger numbers are based on best estimates and publicly available data. For corrections or updates, please feel free to reach out. All data and information presented belongs to their respective owners and is used here for commentary purposes only. Sources are cited throughout.

How TIA Has Changed Since 2019

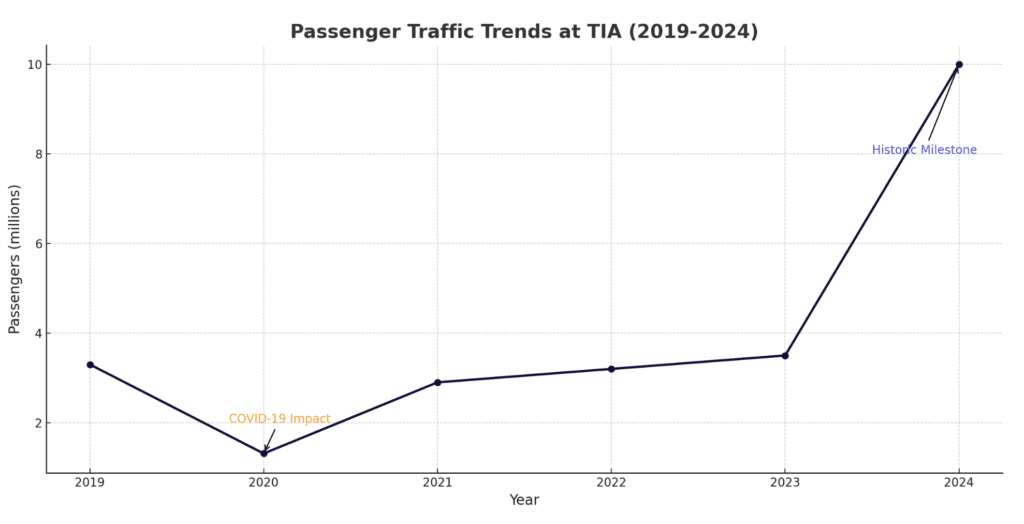

The transformation of TIA over the last five years is nothing short of remarkable. In 2019, the airport handled over 3.3 million passengers, marking a strong year driven by Albania’s growing appeal to tourists and a steady flow of diaspora travelers. By 2020, however, the COVID-19 pandemic slashed passenger traffic to just 1.31 million—a tough 60% drop. This steep decline mirrored global aviation trends, but TIA’s recovery was swift.

Passenger traffic climbed to 2.9 million in 2021 as restrictions eased and demand for travel resurged. By 2022, numbers were approaching pre-pandemic levels, and 2023 saw a full recovery, with passenger totals surpassing those of 2019. In 2024, TIA achieved a historic milestone by welcoming over 10 million passengers by October—a figure far exceeding projections from just a few years earlier. This growth highlights the effectiveness of TIA’s strategic focus on expanding routes, partnering with low-cost carriers, and investing in infrastructure.

Growth Trends and Route Analysis

The rebound from 2019 to 2024 demonstrates the resilience and potential of Albania’s aviation sector. Comparing passenger traffic data over this period and recent months in Q4 of 2024 provides insights into the dynamics of recovery and growth.

Key routes driving growth in Q4 2024:

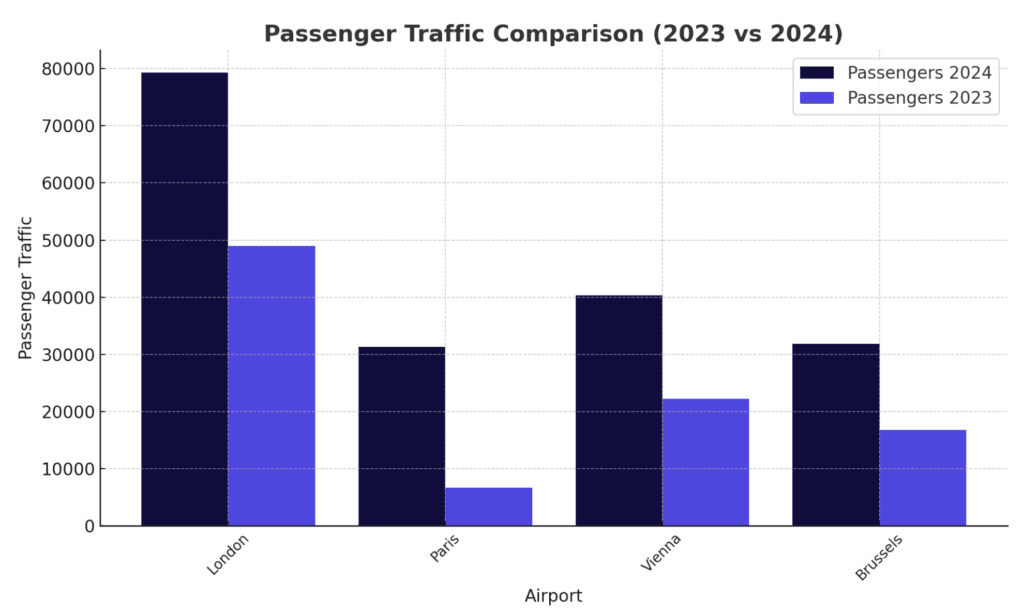

• London: October 2024 saw 79,301 passengers on the London route, a 62% year-on-year increase, making it the busiest destination, as reported by TIA Market Statistics.

• Paris: A standout performer, passenger numbers surged by 366% compared to 2023.

• Vienna and Brussels: Passenger traffic grew by 81% and 90%, respectively, reflecting increased interest in Central European hubs.

These routes highlight not only a recovery from pre-pandemic levels but also an expansion beyond traditional travel patterns. Back in 2019, London and Milan dominated TIA’s traffic, with fewer secondary cities in the network. By 2024, new routes such as Leipzig and Salerno illustrate TIA’s efforts to diversify its offerings, to compare:

Comparing 2019 and 2024 Passenger Trends

In 2019, the most popular routes included London, Milan, and Rome, with traffic heavily skewed toward traditional European hubs. By 2024, while London remains dominant, routes like Paris and Brussels have grown significantly. This shift reflects not only increased travel demand but also a diversification in passenger preferences to the north.

For instance, traffic to Vienna grew by 81% in 2024, signaling its importance as a Central European hub. Similarly, Italian routes such as Bologna and Bari have seen sharp increases in passenger numbers, highlighting the strong cultural and economic ties between Albania and Italy.

Declining routes, such as Belgrade and Milan, point to evolving competition and traveler behavior. These trends are important as TIA continues to refine its route and tourism network.

Emerging and established routes:

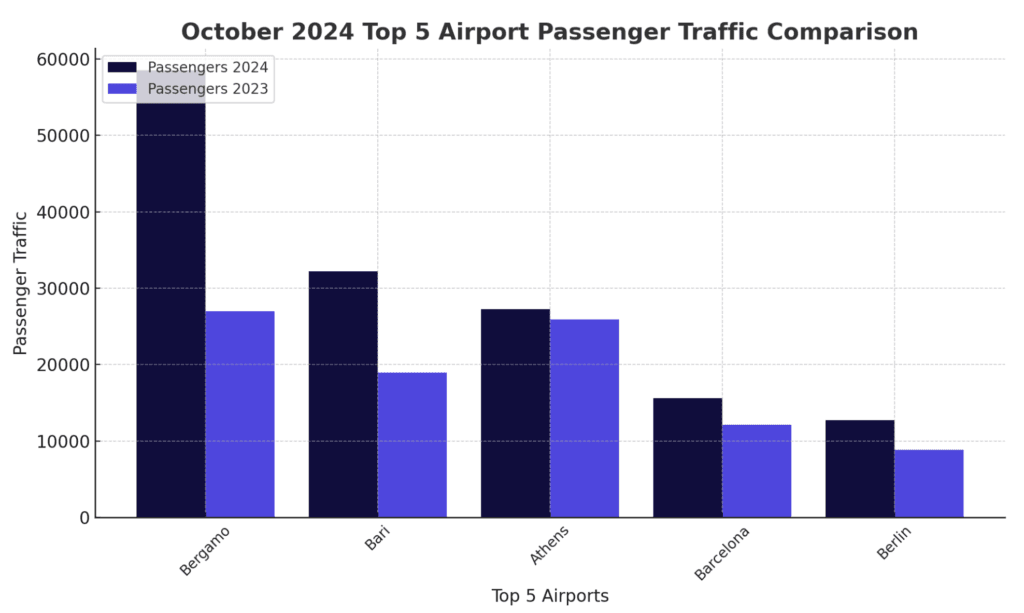

• Newer routes like Leipzig and Salerno performed well, with Leipzig attracting over 5,000 passengers in its early months.`

• Italian destinations, including Bari and Bologna, saw substantial growth, with year-on-year increases of 70% and 43%, respectively.

Decending routes at TIA:

• Traffic to Belgrade fell by 23%, and Milan experienced a slight 5% drop, showcasing the shifting dynamics in regional travel preferences.

Visualizing growth:

• Year-on-year (YoY): 46% growth in total passengers by October 2024 compared to 2023.

• Month-on-month (MoM): An increase of 7.8% from September to October 2024, highlighting an interesting seasonal demand.

Airlines Driving the Growth

Low-cost carriers have played a pivotal role in TIA’s post-2019 recovery. Wizz Air, for instance, accounted for 46% of the airport’s market share in 2024, up significantly from its pre-pandemic footprint. Ryanair followed with a 21% share, leveraging its extensive European network to attract budget-conscious travelers.

In 2019, these carriers were still growing their presence in Albania, with legacy airlines dominating key routes. By 2024, the shift toward low-cost operators has helped TIA attract a broader range of passengers. Air Albania, while smaller, remains strategically important, focusing on regional routes and diaspora travel. This mix of airlines ensures that TIA caters to both budget travelers and those seeking specific regional connections.

Cargo and Freight Operations

The growth in passenger numbers since 2019 has been mirrored, albeit on a smaller scale, in TIA’s cargo operations. In 2019, cargo volumes were modest, with limited facilities for freight handling. By 2024, the Air Transport Statistics Q2 2024 reported 570.8 tons of cargo handled in the second quarter, a 16.4% year-on-year increase.

Mail services accounted for 10.1% of the total cargo volume, reflecting the growing importance of e-commerce and expedited shipping. While cargo operations remain a smaller segment compared to passenger traffic, consistent growth highlights untapped potential in this sector.

Albania’s Airspace: A Strategic Transit Corridor

Albania’s airspace has played a key role in TIA’s growth, particularly as a transit point. The Air Transport Statistics Q2 2024 from INSTAT recorded 102,916 flights passing through Albanian airspace in the second quarter, with 81.9% classified as overpasses. These figures reflect Albania’s geographic position as a bridge between Europe, Asia, and the Middle East.

In 2019, overpass traffic was also a significant feature of Albania’s airspace, but the rise in total flight numbers since then underscores its growing importance in international aviation. (And potential for future Stopover traffic.)

Looking Ahead: Challenges and Opportunities

As TIA grows, it faces both opportunities and challenges. Competition from neighboring airports is intensifying, and sustaining growth will require ongoing investments.

These investments can ensure that TIA continues to attract passengers and airlines. Expanding its cargo infrastructure could be another priority, given the steady growth in freight operations.

INSTAT’s projections emphasize the importance of continued infrastructure investment and harmonized data collection. As passenger numbers continue to grow, ensuring reliable and consistent reporting will aid strategic planning when combined with multiple sources.

Tirana International Airport’s journey from 2019 to 2024 reflects Albania’s rise as a significant player in global aviation. Its recovery from the pandemic, record-breaking passenger numbers, and expanding route network underscore its resilience and strategic importance. With ambitious development plans and strong partnerships, TIA is well-positioned to sustain its upward trajectory, continuing to connect Albania to the world. For more info, check out the sources below.

Sources: Passenger and route data from TIA Market Statistics and broader aviation insights from INSTAT Air Transport Reports.