Take a Taxi With Patoko Today

Use "WEB" referral code, for a free 50 Toko bonus.

Use "WEB" referral code, for a free 50 Toko bonus.

If you’ve just arrived in Albania, especially in Tirana, one of your first questions is probably:

Where’s the closest ATM?

The second question, without a doubt: What are the withdrawal fees?

I’ve found myself walking an extra 500 meters to avoid 2 euro in fees at multibank locations like Kompleksi Delijorgji. This should lay out the answer to the second question: How can I get cash with the least amount of fees?

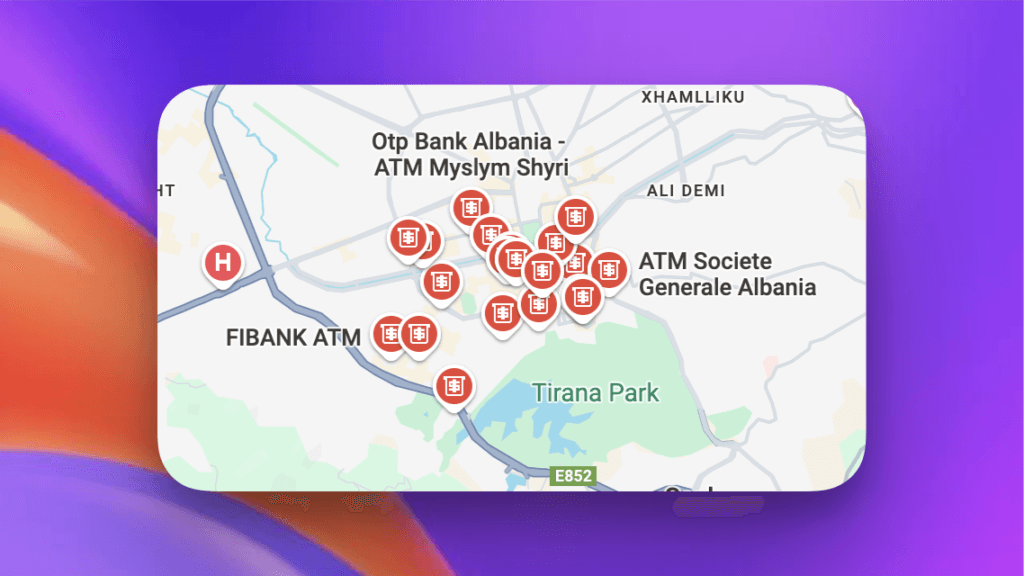

I spent a month visiting and testing over 20+ ATMs in Tirana to answer this for you. Since I used an American-based debit card, keep in mind that the exact fees may vary depending on your card’s issuing country.

Unfortunately, I wasn’t able to find a single ATM that offers fee-free withdrawals for foreign cards. That means you’ll always pay a fixed fee (occasionally, plus a percentage of the withdrawal amount).

If you’re looking to avoid these charges altogether, you may want to consider an alternative: bringing cash (EUR or USD) and exchanging it at a money changer. Many visitors and expats in Albania find that this method offers better exchange rates and fewer hidden fees.

I personally withdrew cash from over 20 ATMs to track the fees and processes involved. I also cross-checked some of the findings with the ATM Fee Saver App to provide the most updated information.

Here, I’ll break down the costs of using different ATMs, organized by fee amount, and compare what the ATM Fee Saver App reports versus my own in-person experience.

This is not financial advice, just my personal findings from testing ATMs in Albania with an American debit card. ATM fees and conversion rates may change at any time. If you find a different fee, feel free to let us know!

Below is a structured table listing the ATMs, their fees, and whether they allow you to decline the ATM’s conversion rate (which is often worse than your bank’s rate).

| Bank | Fee (Lek/€) | ATM Fee Saver App | My In-Person Findings |

|---|---|---|---|

| Credins Bank | 600 Lek | 600 Lek | Sometimes a conversion screen appears. Avoid non-bank rates if possible. |

| Union Bank (Cheapest) | 500 Lek (Visa), 250 Lek + 2.5% (Mastercard) | Visa: 500 Lek, Mastercard: 250 Lek + 2.5% | No option to decline conversion. Uses your bank’s rate. |

| ABI Bank (Cheapest) | 500 Lek | 500 Lek | No screen to select conversion rate. |

| OTP Bank | 700 Lek | 700 Lek | No screen to select conversion rate. |

| Tirana Bank | 700 Lek | 700 Lek | No screen to select conversion rate. |

| Intesa Sanpaolo | 700 Lek | 700 Lek | Offers a conversion screen. Recommend declining and charging in your card’s currency. |

| Fibank | 690 Lek | 690 Lek | Offers conversion, but markup is high (around 9.75%). |

| BKT (Banka Kombëtare Tregtare) | 6-7€ (varies) | 6-7€ | Red ATMs. No option to decline conversion. |

| Raiffeisen Bank | 800 Lek | 800 Lek | No conversion selection available. Offers the only Tap-to-Pay ATMs I could find. |

| ProCredit Bank | 700 Lek | Not listed | No option to decline conversion. |

If you must withdraw cash in Albania, here are some tips to minimize fees:

If you want to avoid ATM fees completely, your best bet is to bring Euros or US Dollars and exchange them at a money changer in the city. Exchange rates in Tirana are typically much better than ATM conversion rates. I’ve had good experiences at Iliria’98 Money Exchanges.

Tip: Avoid exchanging money at the airport—rates are often worse than what you’ll find in the city.

Finding an ATM in Albania isn’t hard, but avoiding high withdrawal fees is tricky. No ATMs in Tirana offer free withdrawals, so your best strategy is either:

I’ll continue updating this guide as I test more ATMs. Let me know if you find different fees than the ones listed above!

Hope this helps you save money on ATM withdrawals in Albania! If you have corrections or insights, please contact us here.